As mortgage rates continue at historic lows, the VA home loan program is being used in record numbers by veterans service members reservists National Guard members and some surviving spouses eligible borrowers have an opportunity to qualify for no down payment home loans in addition to regular and interest rate reduction refinance home loans. VA guaranteed home loans are made by banks and mortgage lenders with VA promising to pay part of the loan amount if the borrower fails to repay the balance and a unique aspect of this VA program is a commitment to help borrowers keep their homes if they encounter financial difficulties. In fact, according to the Mortgage Bankers Association, VA s-- foreclosure and serious delinquency rates for more than a year have been the lowest in the housing industry even when compared to prime loans VA loan specialists can intervene on a veteran's behalf with the loan service to explore Home retention options including repayment plans loan modifications and forbearance.

PDF editing your way

Complete or edit your va form 10 3542 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export va travel reimbursement directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your va travel reimbursement form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your va form 10 3542 fillable by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Va 10-3542

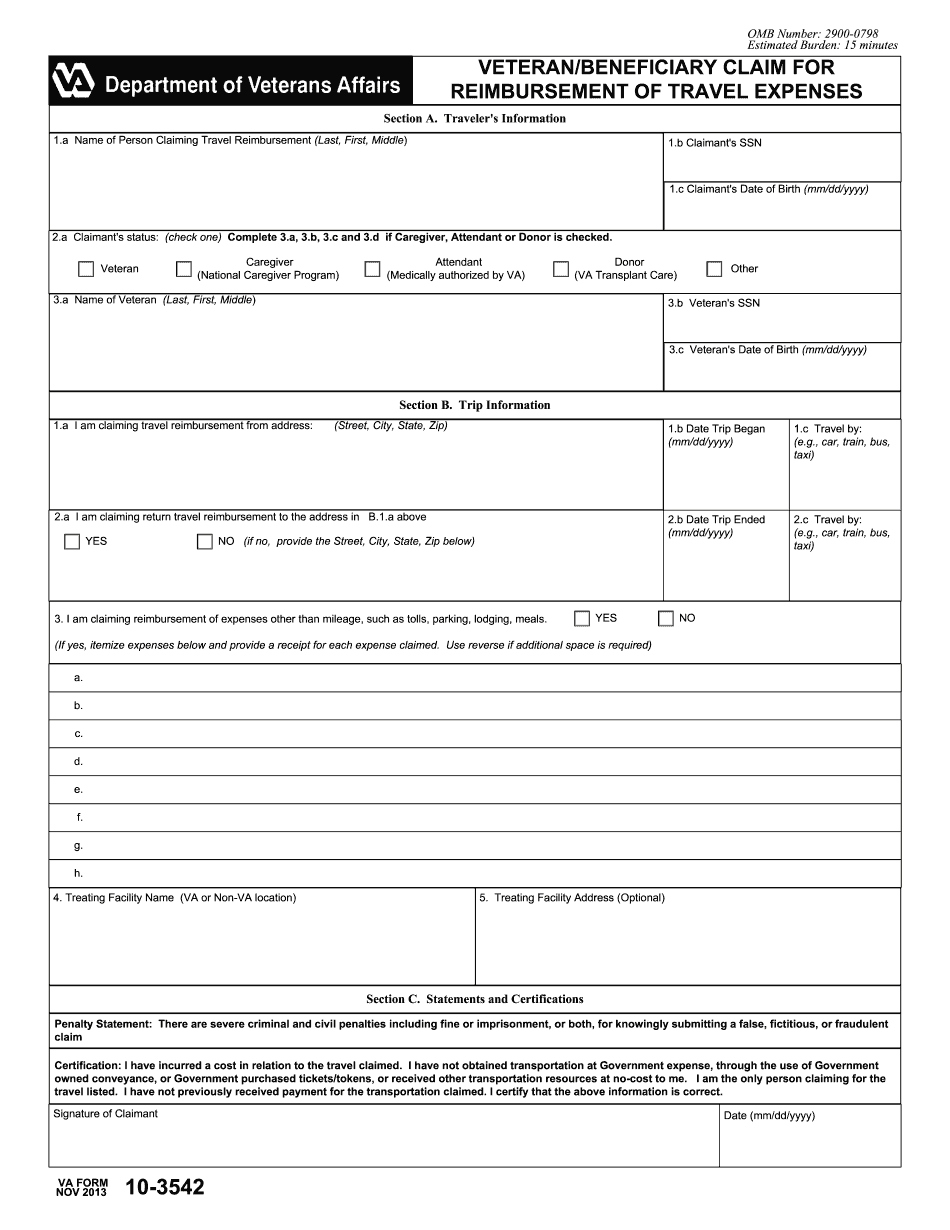

About Form Va 10-3542

Form VA 10-3542 is a document used by the Department of Veterans Affairs (VA) in the United States. It is officially titled as the "Request for and Authorization to Release Protected Health Information." This form is required when a veteran or individual wants to grant authorization for the VA to release their protected health information to another party. The purpose of Form VA 10-3542 is to ensure that the VA complies with federal privacy laws, such as the Health Insurance Portability and Accountability Act (HIPAA). It enables veterans or their designated representatives to specify what information can be disclosed, to whom, and for what purpose. Those who may need to complete this form include veterans who want to allow their healthcare providers, insurance companies, or other relevant organizations to access their medical records or other protected health information. This could be for purposes such as receiving medical treatment from an outside provider, applying for disability benefits, or seeking a second opinion. It is important to note that the VA relies on this form to ensure patient privacy, and the release of protected health information without proper authorization is prohibited. Therefore, individuals who wish to authorize the VA to release their protected health information should complete and submit Form VA 10-3542.

What Is Va Form 10 3542?

This form is used by the eligible veterans and beneficiaries (the eligibility is determined in the instructions) to receive a compensation of travel expenses. For example, if the veterans go to a VA health care facility, they have the right to return the money they spent during the traveling.

This form is a claim for reimbursement of travel expenses. The information provided is used to determine eligibility for travel benefits and services. If eligible, the claim will be processed for payment and the veterans will receive the money back.

Which documents do support the VA 10-3542 form?

In case the applicant wants the reimbursement of non-mileage expenses (parking, bridge, road and tunnel tolls, meals, lodging) he/she has to prthe corresponding receipts.

When is the VA 10-3542 form due?

The claimant must complete the form within 30 days of travel.

How long does it take to fill the form out?

The estimated time of completing the form is 15 minutes. The filler has to prthe following information:

- Name of the claimant, SSN, date of birth

- Claimant’s status (veteran, caregiver, attendant, donor)

- Veteran’s name, SSN, date of birth (if the claimant and the veteran are different people)

- Information about the travel (addresses of start and end points of the travel; date when the trip begins and ends; mean of transport)

- If the claimant claims the reimbursement of expenses other than mileage, he/she should itemize them and prthe receipt for each expense

- The form must also contain the name and address of the treating facility of the veteran

- The claimant should sign and date the form.

What do I do with the form after its completion?

The completed and signed form is sent to the VA health care facility for further consideration. The claim may also be done in person.

Online solutions assist you to prepare your document administration and enhance the productivity of your respective workflow. Observe the quick help in order to finished Form Va 10-3542, steer clear of mistakes and furnish it inside a well timed fashion:

How to complete a Va Form 10 3542 Printable?

- On the website aided by the type, click on Launch Now and go for the editor.

- Use the clues to fill out the relevant fields.

- Include your own information and facts and speak to knowledge.

- Make convinced you enter appropriate details and numbers in suitable fields.

- Carefully take a look at the articles of the form in addition as grammar and spelling.

- Refer to help part for people with any doubts or deal with our Aid workforce.

- Put an digital signature on your Form Va 10-3542 using the guidance of Sign Resource.

- Once the shape is accomplished, push Carried out.

- Distribute the completely ready type via email or fax, print it out or save on the product.

PDF editor allows for you to definitely make changes to your Form Va 10-3542 from any online linked product, customise it as outlined by your requirements, signal it electronically and distribute in numerous means.

What people say about us

Access professional filing capabilities

Video instructions and help with filling out and completing Form Va 10-3542